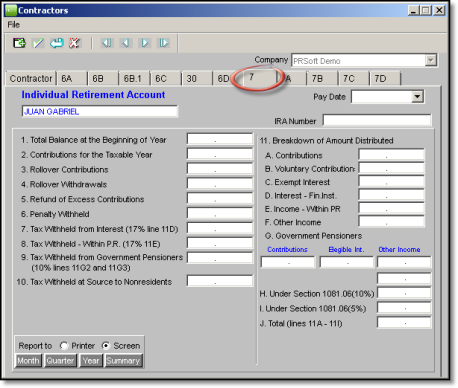

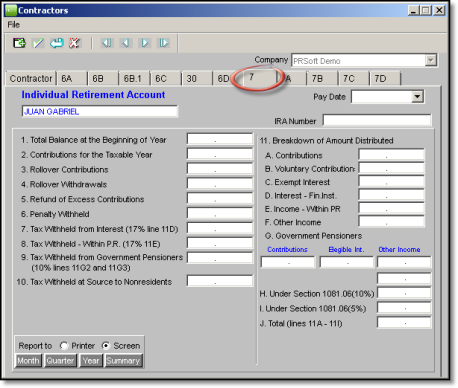

Use Form 480.7 to track contractor's contributions to an Individual Retirement Account (IRA). You may enter this data at the end of the year in one lump, or throughout the year as payments are made.

on the toolbar or click File

> Save Changes.

on the toolbar or click File

> Save Changes.©PRSoft, Inc. January, 2013

All Rights Reserved.

753 Hipódromo Ave.

San Juan, PR 00909

Tel (787) 622-7550

Fax (787) 641-3013