E-file 941-PR

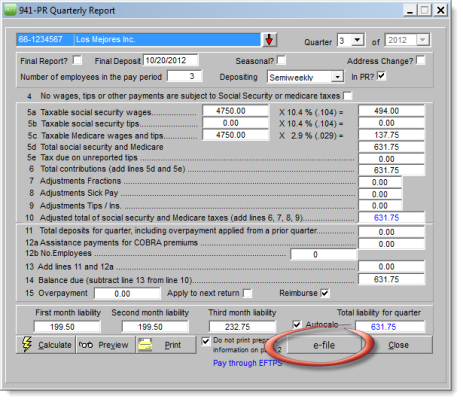

This new functionality allows you to electronically send your 941-PR return to the IRS. Follow these steps to do it.

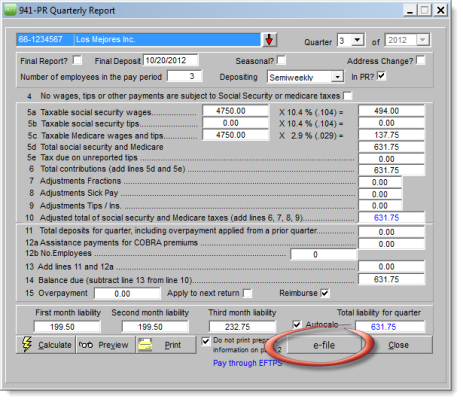

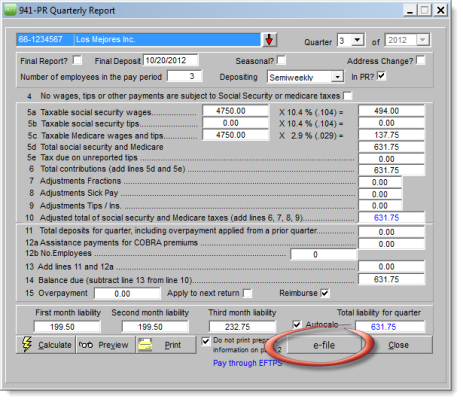

- Once you complete the 941-PR Quarterly Report window the information to be sent, click the e-file button.

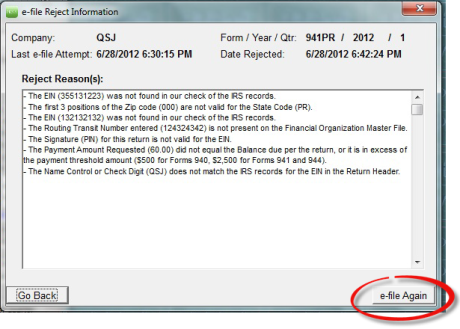

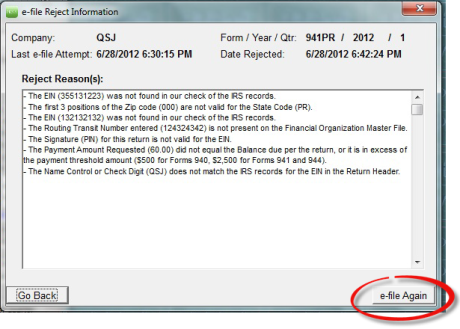

- If the e-file button is not available and instead it displays "e-file Reject" click it to review why this error is occurring. The e-file Reject Information window displays.

- Review the reasons and make the necessary changes in the return.

Important Notice: Make sure errors are corrected before e-filing.

- Then, click the e-file Again button located at the bottom right corner of the screen to continue. The e-file Information window displays.

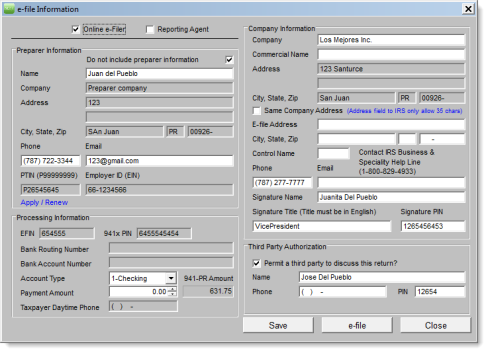

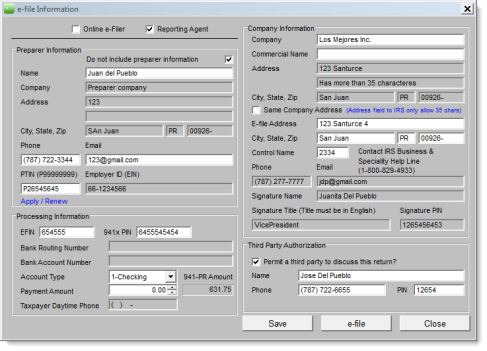

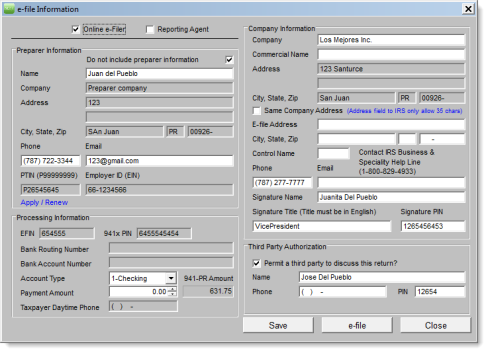

- Click Online e-filer if you are e-filing only one return. If you are preparing several returns, click Reporting Agent. Notice how the fields enabled change throughout the window. According to your selection continue in the corresponding section below. See "Online e-filer" or See "Reporting Agent".

Online e-filer

Preparer Information Section

This section retrieves data from the Preparer tab. To edit it, go to Preparer in the Setup window.

- Click Do not include preparer information checkbox if the preparer is the person submitting the return. If clicked, fill out the Name, Phone and Email fields.

- If you did not select the checkbox, enter the Name, Company, Address, Phone, Email, and Employer ID.

- The PTIN field cannot be edited. To edit this data, go to Preparer tab in the Setup window.

Note: The PTIN (Paid Preparer Tax Identification Number) is required only for Reporting Agents who are filing returns on behalf of their customers. If you are not an Agent, it should be blank.

- If necessary, click the Apply / Renew link to open the PTIN renewal form.

Processing Information Section

- The EFIN and 941x PIN are retrieved from the Preparer tab in the Setup window.

Note: The EFIN (Electronic Filing Identification Number) and the 941x PIN are required only for Reporting Agents. If you are not an Agent, they should be blank.

- Enter the Payment Amount. Besides is displayed the amount calculated in the 941 return.

- The Bank Routing Number and the Bank Account Number fields become available when the Payment Amount is higher than 0.00. Enter the routing and account number in the appropriate field.

- From the Account Type select Checking or Savings.

- In Taxpayer Daytime Phone enter the telephone number.

Company Information Section

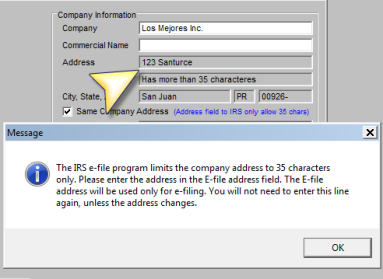

- In Company Information, review the Company and Commercial Name fields. To edit the Address, go to Companies in the Data Entry menu.

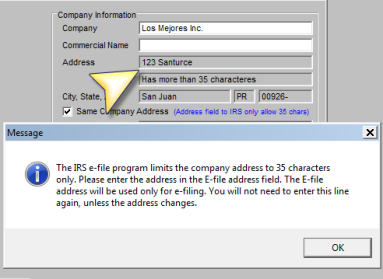

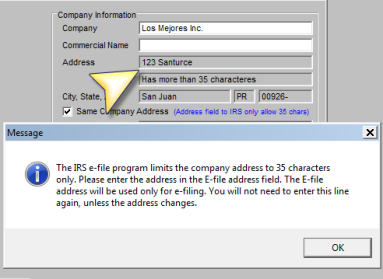

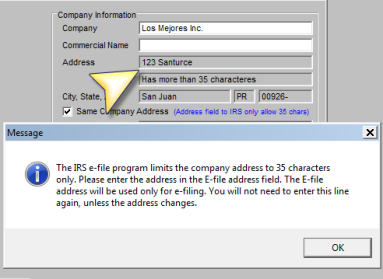

- Click the Same Company Address checkbox if the address above is the one to be used for e-filing purposes.

If clicked, make sure the address does not have more than 35 characters (including spaces). If it has more than 35 characters an error message is displayed.

- If the error message is displayed, click OK enter a shorter version of the address in the E-file Address field. Remember, it must contain less than 35 characters.

- Enter the Control Name provided by the IRS.

- Review the Phone and Email address.

- Make sure the Signature Name includes the name of the person signing the return.

- Review the Signature Title and Signature PIN.

Third Party Authorization Section

- Click the Permit a third party... checkbox if applicable. If selected, enter or review the Name, Phone and PIN.

- Click Save if you're not ready to send this return right away. The next time you open this window for this company it will display the last changes made.

- To send the return now, click e-file. The system will display a status message:

- Pending - The IRS received the return and it's processing it.

- Rejected - The IRS did not accept the return.

- Completed - The return was successfully submitted to the IRS.

- Click Close to exit this window without making any changes.

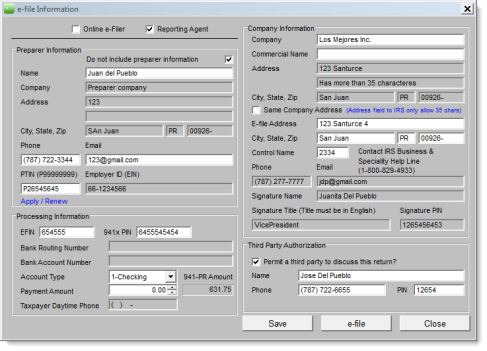

Reporting Agent

Preparer Information Section

This section retrieves data from the Preparer tab. To edit it, go to Preparer in the Setup window.

- Click the Do not include preparer information checkbox if the preparer is the person submitting the return. If clicked, fill out the Name, Phone and Email fields.

- If you did not select the checkbox, enter the Name, Company, Address, Phone, Email, PTIN and Employer ID.

You can also edit the Preparer information in the Preparer tab in the Setup window.

- If necessary, click the Apply / Renew link to open the PTIN renewal form.

Processing Information Section

- The EFIN and 941x PIN are retrieved from the Preparer tab in the Setup window.

- Enter the Payment Amount. Besides is displayed the amount calculated in the 941 return.

- The Bank Routing Number and the Bank Account Number fields become available when the Payment Amount is higher than 0.00. Enter the routing and account number in the appropriate field.

- From the Account Type select Checking or Savings.

- In Taxpayer Daytime Phone enter the telephone number.

Company Information Section

- In Company Information, review the Company and Commercial Name fields. To edit the Address, go to Companies in the Data Entry menu.

- Click the Same Company Address checkbox if the address above is the one to be used for e-filing purposes.

If clicked, make sure the address does not have more than 35 characters (including spaces). If it has more than 35 characters an error message is displayed.

- If the error message is displayed, click OK enter a shorter version of the address in the E-file Address field. Remember, it must contain less than 35 characters.

- Enter the Control Name provided by the IRS.

- Review the Phone and Email address.

- Make sure the Signature Name includes the name of the person signing the return.

- Review the Signature Title and Signature PIN.

If necessary, you can edit the phone and email in the Information tab, and the signature name, title, and PIN in the Miscelaneous tab.

Third Party Authorization Section

- Click the Permit a third party... checkbox if applicable. If selected, enter or review the Name, Phone and PIN.

- Click Save if you're not ready to send this return right away. The next time you open this window for this company it will display the last changes made.

- To send the return now, click e-file. The system will display a status message:

- Pending - The IRS received the return and it's processing it.

- Rejected - The IRS did not accept the return.

- Completed - The return was successfully submitted to the IRS.

- Click Close to exit this window without making any changes.

©PRSoft,

Inc. January, 2013

All Rights Reserved.

753 Hipódromo Ave.

San Juan, PR 00909

Tel (787) 622-7550

Fax (787) 641-3013